In the event of your death, financial support may be a significant issue for your family. Day-to-day living expenses, bills and so on, will still have to be met by those you leave behind. This is why the benefits of the GRA Group Life Plan are so valuable for GRA members.

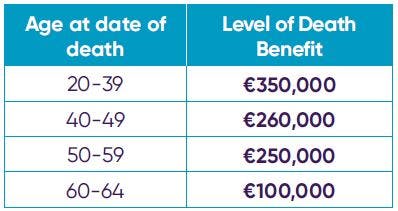

If a serving member of the Plan dies, a lump sum will be paid:

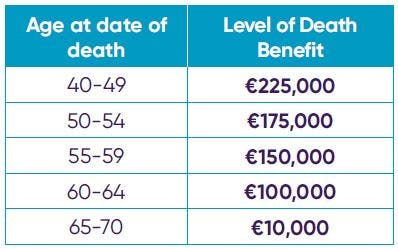

If a retired member of the Plan dies, a lump sum will be paid:

If a member reaches age 65 on or after 1st January 2019, they will be eligible for cover of €45,000 up to age 70, provided they maintain premium payments of €31.85 per month (€7.35 per week).

However, if a member reaches age 65 before 1st January 2019 they will continue with the current benefit of €10,000 up to age 70.

A lump sum will be paid if a trainee member dies: €30,000 if during the first 32 weeks of training and €60,000 if during weeks 33-64 of training

A lump sum of €115,000 will be paid to a serving GRA member on the death of their spouse or partner.

Terms, conditions and exclusions apply.

Cornmarket and the GRA work together to secure the best price and benefits for members. When it comes to cost, you benefit from the group purchasing power of the GRA.

Membership of the Plan is free for trainee gardaí during their 64 weeks of training. After that, the cost of this Plan is €7.35 gross per week. While you are working the majority of your premium is eligible for tax relief. Please note there is no tax relief for retired members

Cornmarket negotiate with insurers to obtain the most competitive rates and to secure the best possible benefits for members.

You must be a member of the GRA or a full-time member of a recognised staff association in An Garda Síochána to be an eligible member of the Plan. On promotion you can continue your membership of the Plan as long as you are a full-time member of the recognised staff association for your rank.

GRA Group Life Plan is underwritten by Irish Life Assurance plc. Irish Life Assurance plc is regulated by the Central Bank of Ireland.