MyHealthCheck

The PNA, in partnership with Cornmarket, are delighted to launch MyHealthCheck for PNA Salary Protection Scheme members. MyHealthCheck is a health screening programme designed to help members get ahead of their health.

Find out more

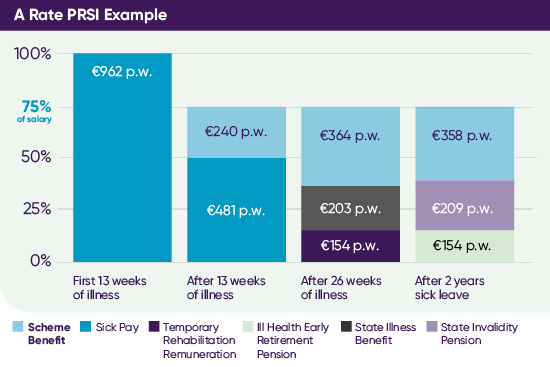

This scheme is designed to provide you with a replacement income of up to 75% of salary* if you’re ill or injured, and can’t work. It helps give financial security and peace of mind, so you can focus on getting better.

The PNA, in partnership with Cornmarket, are delighted to launch MyHealthCheck for PNA Salary Protection Scheme members. MyHealthCheck is a health screening programme designed to help members get ahead of their health.

Find out more

Salary protection gives you a replacement income of up to 75% of your annual salary* – if you can't work due to illness or injury, and your sick pay has reduced to half pay or ceased altogether.

*Up to 75% less any other income to which you may be entitled e.g. half pay, Ill Health Early Retirement Pension, Temporary Rehabilitation Remuneration, State Illness Benefit. You can claim salary protection when you have used up your employer’s sick leave entitlements and passed the scheme ‘deferred period’. Simply put, that’s the time that must pass before benefit is paid.

The Scheme provides a lump sum of typically three times your annual salary if you die. This can help to pay bills and unexpected costs, at an already difficult time.

You will receive a once-off lump sum if you are diagnosed with one of the Specified Illnesses listed in the policy document.

If your spouse or civil partner dies, you’ll receive a payment of one year's salary.

OR

If you’re single, and suffer a Specified Illness you’ll receive an extra 25% of your annual pensionable salary.

You're entitled to tax relief on the majority of your Scheme membership cost.

Our helpful and friendly team will guide you through the claims process.

Remember, we're not automatically notified if you’re absent from work due to illness or injury. If this happens, it's important to contact us as soon as you think your salary will be affected.

To be eligible to claim from Salary Protection, you must meet the definition of disablement as defined in the policy document. Other terms, conditions and exclusions apply.

This potentially life-saving programme was relaunched for eligible members of the Salary Protection Scheme for PNA members in 2023, for a limited time. This was the second time it was run for scheme members. The results show it is still as powerful as ever.

Learn moreMyDoc, an easy online healthcare service, is now available to members of the PNA Salary Protection Scheme. This means Scheme members and their family can book free consultations with a doctor, get prescriptions, sick certs and open referral letters to private care, whenever and wherever they need to!

Learn MoreWhen you’re ill or injured and can’t work your Scheme helps you with a replacement salary. Separately, this service supports your return to health using Irish Life’s internal nursing team, and a range of rehabilitation programmes and therapies, at no additional cost!

Learn moreIt’s simple to find out!

Enter the number of sick days you’ve had in the last 4 years.

Then enter the number of sick days you’ve had in the last 12 months, and we’ll tell you:

Note: This is an estimate of your remaining paid sick leave based on our understanding of the Public Service Sick Leave Regulations (at July 2021) and on the information provided by you. For exact sick leave details please contact your employer. The example is based on ordinary sick leave regulations for a public sector worker with 20 years of service, paying A1 PRSI and who is 45 years old. It does not take into account any extended paid sick leave granted under the Critical Illness Protocol or pregnancy related illness which may extend the period of paid sick leave.

It's surprising how quickly your sick days can add up, especially when you consider you are looking back over the past 4 years. An unexpected illness or injury can happen to anyone, at any age. Be prepared and protect your income today!

This graph example is based on a Public Sector employee, who is a member of the Superannuation Scheme with 20 years' service earning €50,000 per annum, who is now unable to work due to disability arising from illness or injury. It is assumed that standard Public Sector sick leave arrangements apply, extended paid sick leave under the Critical Illness Protocol does not apply and Ill Health Early Retirement Pension is granted after 2 years. Social welfare rates are as at July 2021.

Cornmarket and the PNA work together to secure the best price and benefits for PNA members. When it comes to cost, you can benefit from the group purchasing power of your union. You're entitled to tax relief on the majority of your Scheme membership cost.

Please review the Plan documents above to apply for the Plan, and click here to access our Terms of Business.

Send your completed application form to:

Cornmarket Group Financial Services Ltd.

Group Protection Department

Christchurch Square

FREEPOST F3976

Our helpful and friendly team will guide you through the claims process.

Call us on (01) 408 4018

This scheme is underwritten by Irish Life Assurance plc. Irish Life Assurance plc is regulated by the Central Bank of Ireland.