We are experts in Public Sector finance and that’s why we have put together this Guide to Budget 2019 which focuses on what it means for you as a Public Sector employee.

Budget Summary

- Income Tax standard rate band to increase by €750

- Universal Social Charge (between €19,874 – €70,044) to be reduced by 0.25%

- Welfare & pension payments to increase by €5 per week

- Parents to receive two additional weeks’ paid leave within a child’s first year

![]()

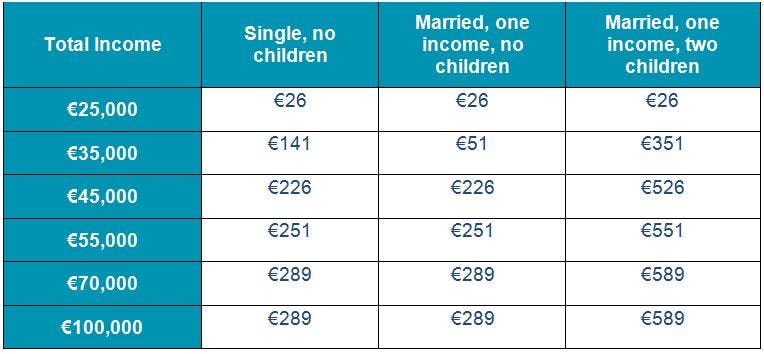

Single Income Household

The above examples are based on the income tax standard rate bands for single, married or civil partnership households. Those in receipt of the Single Person Child Carer Credit receive an extra €4,000 on the standard rate cut-off point. Therefore after Budget 2019, the income tax standard rate band is €39,300 for parents in receipt of the Single Person Child Carer Credit and who are single, widowed or a surviving civil partner. For financial advice that is specific to your circumstances, call(01) 420 6757 to speak to one of our expert financial consultants.

![]()

Two married PAYE employees with two children

![]()

Income Tax – the income tax standard rate band is to increase by €750 for all earners:

- from €34,550 to €35,300 for single individuals and

- from €43,550 to €44,300 for married couples.

USC

- €0 – €12,012 at 0.5% (no change)

- €12,012 – €19,874 at 2% (ceiling raised from €19,372 to €19,874)

- €19,874 – €70,044 at 4.5% (cut from 4.75%)

Rented Residential Property – Mortgage interest deduction for rental properties has increased from 80% to 100%. This is effective from 1st January 2019.

Home Carer Tax Credit – to increase from €1,200 to €1,500

Self-employed – an increase in the Earned Income Credit from €1,150 to €1,350

Minimum hourly wage – an increase in the minimum wage from €9.55 to €9.80 per hour

Social Welfare

- Welfare payments to increase by €5 per week

- Christmas bonus payment to increase to 100% (previously 85%)

Medical Prescriptions

- Prescription charges reduced by 50 cents for all medical card holders over age 70 (cut from €2.00 to €1.50).

- Threshold for the Drugs Payment Scheme reduced from €134 to €124

Vehicle Registration Tax (VRT)

- VRT on all diesel engine motor vehicles to increase by 1%

- VRT relief for hybrids has been extended to the end of 2019

Inheritance Tax – The Group A threshold (parent to child) to be increased from €310,000 to €320,000

Other

- Parents to receive two additional weeks’ paid leave within a child’s first year (from November 2019)

- Cigarettes – increased by 50 cents per packet

- Newspapers – 9% VAT rate to be extended to digital publications

![]()

Economy & jobs

- VAT rate for hotels, restaurants and hairdressing will increase from 9% to 13.5%

- 12.5% Corporation Tax rate to remain

- Public Service Employment:

- 800 additional Gardaí

- 1,300 new Teachers and 950 new Special Needs Assistants

![]()

For additional advice on your finances following Budget 2019, you can make an appointment with an expert Cornmarket Consultant here or or call us on (01) 420 6757.

Please note: there may be further changes to the above information following the Finance Bill. Every effort has been made to ensure that the information provided here is accurate and up-to-date (as at 9th October 2018). The information provided is of a general nature and may not address the specific circumstances of a particular individual. Cornmarket does not accept any liability arising from any errors or omissions.