MyHeartMatters

MyHeartMatters is a Cardiovascular Screening Programme designed to help DCU Income Protection Plan members take control of their heart health.

Find out more

This plan is designed to give you a replacement income* to help you if you're ill, or injured, and can't work.

It’s financial security and peace of mind, so you can focus on getting better.

MyHeartMatters is a Cardiovascular Screening Programme designed to help DCU Income Protection Plan members take control of their heart health.

Find out more

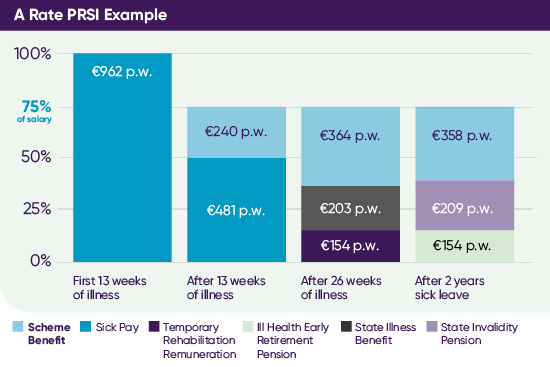

Income protection gives you a replacement income of up to 75% of your annual salary* – if you can't work due to illness or injury, and your sick pay has reduced to half pay or ceased altogether.

*Less any other income to which you may be entitled e.g. half pay, Ill Health Early Retirement Pension, Temporary Rehabilitation Remuneration, State Illness Benefit. You must exhaust your employer’s sick leave entitlements and the plan deferred period as noted in the policy document.

The plan provides a lump sum of typically twice your annual salary if you die. This can help to pay bills and unexpected costs, at an already difficult time.

You will receive a once-off lump sum if you are diagnosed with one of the Specified Illnesses listed in the policy document.

You're entitled to tax relief on the majority of your plan membership cost.

Our helpful and friendly team will guide you through the claims process.

Remember, we're not automatically notified if you’re absent from work due to illness or injury. If this happens, it's important to contact us as soon as you think your salary will be affected.

It’s simple to find out!

Enter the number of sick days you’ve had in the last 4 years.

Then enter the number of sick days you’ve had in the last 12 months, and we’ll tell you:

Note: This is an estimate of your remaining paid sick leave based on our understanding of the Public Service Sick Leave Regulations (at July 2021) and on the information provided by you. For exact sick leave details please contact your employer. The example is based on ordinary sick leave regulations for a public sector worker with 20 years of service, paying A1 PRSI and who is 45 years old. It does not take into account any extended paid sick leave granted under the Critical Illness Protocol or pregnancy related illness which may extend the period of paid sick leave.

It's surprising how quickly your sick days can add up, especially when you consider you are looking back over the past 4 years. An unexpected illness or injury can happen to anyone, at any age. Be prepared and protect your income today!

This graph example is based on a Public Sector employee, who is a member of the Superannuation Scheme with 20 years' service earning €50,000 per annum, who is now unable to work due to disability arising from illness or injury. It is assumed that standard Public Sector sick leave arrangements apply, extended paid sick leave under the Critical Illness Protocol does not apply and Ill Health Early Retirement Pension is granted after 2 years. Social welfare rates are as at July 2021.

Cornmarket and DCU work together to secure the best price and benefits for DCU employees. When it comes to cost, you can benefit from the group purchasing power of your employer. You're entitled to tax relief on the majority of your plan membership cost.

Please review the Plan documents above to apply for the Plan, and click here to access our Terms of Business.

Send your completed application form to:

Cornmarket Group Financial Services Ltd.

Group Protection Department

Christchurch Square

FREEPOST F3976

Our helpful and friendly team will guide you through the claims process.

Call us on (01) 408 4018

Aviva Life & Pensions Ireland Designated Activity Company, trading as Aviva Life & Pensions Ireland and Friends First, is regulated by the Central Bank of Ireland.