Income protection pays a replacement income of a fixed benefit* – if you can't work due to illness or injury, and your sick pay has reduced to half pay or ceased altogether.

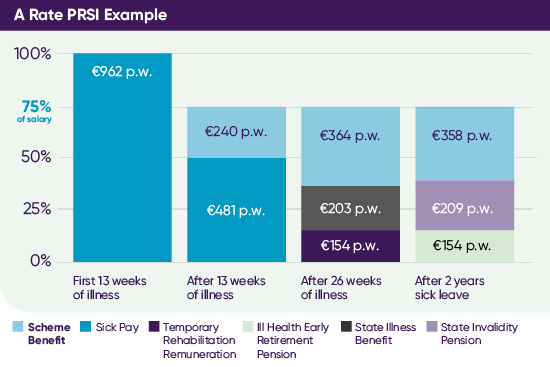

*Less any other income to which you may be entitled e.g. half pay, Ill Health Early Retirement Pension, Temporary Rehabilitation Remuneration, State Illness Benefit. You must exhaust your employer’s sick leave entitlements and the plan deferred period as noted in the policy document.

You're entitled to tax relief on your plan membership cost.

Our helpful and friendly team will guide you through the claims process.

Remember, we're not automatically notified if you’re absent from work due to illness or injury. If this happens, it's important to contact us as soon as you think your salary will be affected.

To be eligible to claim from income protection, you must meet the definition of disablement as defined in the policy document. Other terms, conditions and exclusions apply.