RSA Teachers Scheme Motor FAQ

1. Who do I call to make a claim on my motor insurance?

You should notify the underwriter of the policy about an accident as soon as possible. If you wish to report a new claim or discuss an existing claim, please contact RSA, the underwriter of your policy on 1890 29 02 36.

2. What should I do if I have a car accident?

In the event of an accident you should:

a.Telephone RSA’s Motor Claims Assist on LoCall no. 1890 29 02 36 with the first notification of your claim. They will advise you what to do next and issue all appropriate documentation immediately.

b.Where comprehensive cover applies RSA’s Recommended Repairer Network can be availed of who in the case of the vehicle being unfit to drive will tow the vehicle. This will safeguard the vehicle from further damage from vandals or against theft of parts. Repairs can commence immediately. If the Recommended Repairers are not used, obtain an estimate and advise us immediately and we will appoint an assessor if necessary.

c.When repairs have been completed pay any contribution for which you may be responsible for (please refer to your policy excess) and take delivery of your car.

3. What should I do if my car us stolen or damaged?

If your car is stolen or damaged as a result of theft or malicious damage, immediately report the matter to the Gardaí. The incident must also be reported to RSA, the underwriter of your policy on 1890 29 02 36.

4. What do I do if I damage my windscreen?

In the event of windscreen damage, you should notify our approved repairer, All-Glass, as soon as possible on 1890 809 808.

Please see below for cover applicable to your policy.

Teachers Select windscreen Cover

Approved Repairer €600*

Unapproved Repairer €225*

Teachers Economy windscreen Cover

Approved Repairer €400*

Unapproved Repairer €225*

*Cover applies up to this amount.

Any payment will have no effect on your No Claims Bonus, and we will not ask you to pay any excess if you claim.

5. Do I have to use an approved repairer?

No, you do not have to use an insurer approved repairer. However, you need to be aware that there are lower limitations on the amount of cover that will apply if you choose to use someone other than the approved repairers.

To view the policy excess applicable to your policy please refer to “What is a policy excess?” in the FAQ.

For more information on approved repairers please contact RSA on 1890 29 02 36.

6. What is a policy excess?

This is the first amount of any claim you must pay. There are different excesses applicable depending on the age of the driver, the type of claim and whether an approved repairer is used.

Please see below for excesses applicable to your policy:

Teachers Select Standard Excess

Age of Driver 25+ Approved Repairer €175

Unapproved Repairer €250

17-24 Approved Repairer €425

Unapproved Repairer €500

Teachers Economy Standard Excess

Age of Driver 25+ Approved Repairer €450

Unapproved Repairer €500

17-24 Approved Repairer €750

Unapproved Repairer €800

7. How will a claim affect my insurance?

If you have a claim, it may increase the cost of your premium when your policy is due for renewal. Your No Claim Bonus may also be affected; this depends on the level of No Claim Bonus Protection you have on your policy. Please refer to the policy benefits section or to the No Claim Bonus section.

8. What is a No Claim Bonus?

Every year dependent on your claim experience, you may earn a No Claim Bonus, for which you will receive a discount off your annual insurance premium. The more years No Claim Bonus earned, the higher the discount off your premium, subject to RSA’s maximum. If you make a claim on your policy your No Claim Bonus could be reduced to nil at your next renewal unless you have availed of one of our No Claim Bonus Options:

- Full NCB Protection: You can make 1 unlimited claim in a 3 year period with no effect on your NCB. Subsequent claims will step back the NCB by 3 years. (Excl. Fire/Theft claims or Windscreen claims).

- Step back NCB Protection: If you make a single claim or one arises during any period of insurance, we will reduce your No Claim Discount by 3 years e.g. 5 years to 2 years, 4 years to 1 year etc.

- NCB protection for Fire/Theft/Windscreen: Any payment we make for fire, theft, or windscreen claims will not affect your No Claim Discount.

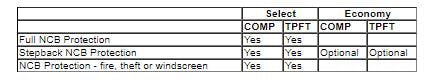

Please see table below for what level of NCB applies for your policy cover:

Please note under the Teacher’s Select policy, once you have had a full no claims discount on the scheme for 7 years, RSA will protect your NCB free of charge for life while you hold this product. Your certificate of insurance will indicate if this benefit applies.

9. Who should I call if my car breaks down?

In the event of your car breaking down please contact Mapfre on 1800 377 700. This is a 24/7 Roadside & Driveway assistance service.

10. Can I switch car insurance from one car to another?

Yes, you can avail of a temporary substitution (usually if your car is in a garage getting repaired) or a permanent substitution (if you are changing your car permanently).

In order to change the car on cover, you will need to contact the Customer Service Helpdesk on (01) 4084020. Please ensure before contacting us, you have the make and model, registration, engine size and value of the car you wish to switch to.

11. Who can drive my car?

The car insurance cover is restricted to persons named on the certificate, including the policyholder. Open Driving option (explanation provided below) is available as an optional extra on the Teacher’s Select Scheme but must be specifically requested.

12. What is open driving?

For an extra premium, with open driving as your selected driving option, you can allow any driver aged 25 to 74 years who are not named on the policy to drive your car once they have a full EU driving licence.

Open driving is available on the Teacher’s Select policy only and is not available on the Teacher’s Economy policy.

To avail of the open driving option, please contact the customer service helpdesk on (01) 4084020. Terms and conditions do apply.

13. Can I add a temporary driver to my policy?

Yes, RSA can provide cover up to 1 month; drivers are subject to our normal underwriting criteria and charges will depend on period of cover, driver age and licence type.

In order to add a driver to your policy, you will need to contact the helpdesk on (01) 4084020. Please ensure you have the name, date of birth, licence type, driving history (convictions, medical conditions, penalty points etc.) and occupation of the driver(s) to be added prior to contacting us.

14. What is driving of other cars?

Driving of other cars allows you to drive other private motor vehicles on a third party or comprehensive basis, where the vehicle value does not exceed €50,000 and the vehicle’s engine size does not exceed 5,000cc. Motorcycles, vans/minibuses/commercial vehicles are excluded and the vehicle must not belong to the policyholder or the policyholder’s employer and must not be hired to him/her under a hire purchase agreement.

Please refer to the below table to see if this benefit applies to you:

Select Economy

Driving of other cars (Fully comprehensive) Yes Yes

Driving of other cars (Third Party only) Yes Yes

15. Am I insured to drive in Europe?

Full policy cover applies only in the Republic of Ireland and the United Kingdom.

To ensure that your current level of protection is maintained for travel to any other country you must let us know before you make the trip. We will require the dates of your trip and the countries to be visited.

Under the Teacher’s Select Policy, benefit is included as part of the policy, cover applies for a single trip up to 60 days.

Under the Teacher’s Economy policy, cover is available on a referral basis and there may be an additional premium for this benefit.

Green cards are not necessary for travel in most European countries. For travel to a country which still requires a Green Card to be issued, this will also be included at no additional cost.

You must remember to take your policy and Certificate of Insurance with you.

16. How do I make changes to my policy?

Whether you want to add a driver to your car insurance policy, change your address or change your car, you can contact one of our Car Insurance Experts on (01) 4084020. We will discuss the changes to your policy that you need and if there will be any additional charge to your car insurance premium or any change to the terms and conditions of your Car Insurance Policy.

17. How do I renew my policy?

Your renewal notice is based on the most recent information supplied by you. If these details have changed, please contact us immediately so we can update your details and issue you with a revised renewal notice if necessary. It is possible to save money on your car insurance premium. Below are a few ways in which you could reduce your costs:

Review your annual mileage, your level of cover and driving restriction.

If you pass your test, let us know.

18. How do I renew my policy? (Continued)

Once you have checked your Cover details and are happy, please proceed to payment options below to complete your renewal.

1. RENEW ON MYCORNMARKET

Select Renew Policy from the home page and follow the easy steps. All you will need is:

A credit/charge/debit card

If your renewal date has passed, or if you experience difficulty using our online facility, please contact the Customer Service Helpdesk on (01) 4084020 between the hours of 9am and 7pm, Monday to Thursday and 9am to 5.30pm on Friday’s.

2. RENEW ONLINE

Log on to www.cornmarket.ie and click on the ‘Renew Your Policy’ button and follow the easy steps. All you need is:

A credit/charge/debit card

Your policy number

Your renewal pin – which is supplied on your renewal notice.

If your renewal date has passed, or if you experience difficulty using our online facility, please contact the Customer Service Helpdesk on (01) 4084020 between the hours of 9am and 7pm, Monday to Thursday and 9am to 5.30pm on Friday’s.

18. How do I renew my policy? (Continued)

3. RENEW OVER THE PHONE

a. BY DIRECT DEBIT

Premiums will be paid from your bank account over 11 months. Charges are detailed on the direct debit mandate included in your renewal pack.

Please note if you are switching schemes from renewal a 30% deposit will be required to be paid upfront and the remaining premium will be paid from your bank account over 10 months. Charges are detailed on the direct debit mandate included in your quotation pack.

b. CREDIT/CHARGE/DEBIT CARD

Your annual premium can be paid in full by credit/charge/debit card. Please call the Customer Service Helpdesk on (01) 4084020.

c. RENEW BY POST

A cheque or bank draft can be made payable to ‘Cornmarket Group Financial Services Ltd.’ Please send all payments to:

Cornmarket Group Financial Services Ltd.,

Christchurch Square,

Dublin 8.

19. How can I get proof of my NCB?

If your policy with us ends at renewal, your renewal invitation will contain proof of your No Claims Discount. If you cancel at any other point in your contract, we will forward proof of your No-Claims Discount once your cancellation has been processed.

20. How can I suspend/ cancel my policy?

In order to suspend/cancel your policy we will need written instruction from you confirming the policy number and the suspension/cancellation date. We will also need to know the reason for suspending/cancelling the policy. We require you to return the original Certificate and Disc of Insurance. Once all required documents are received, we can suspend/cancel the policy from the date received or from a future date if specified.

All required documents can be returned to:

Motor Department

Cornmarket Group Financial Services Ltd.,

Christchurch Square,

Dublin 8.