Did you notice a little bit extra in your take home pay this year? Great News - the contribution you make towards your Public Sector Pension may have been reduced. As your Public Sector Financial Expert we’re going to show how you could use the extra money to invest in your future!

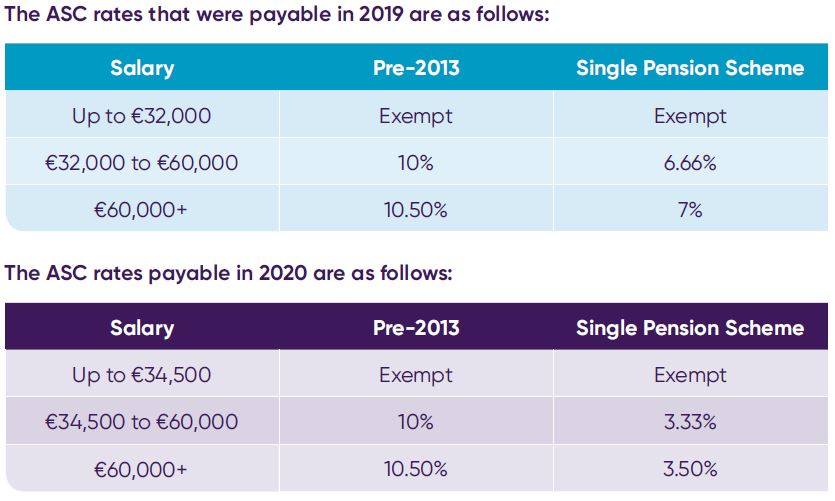

So what is the Additional Superannuation Contribution (ASC)?

The ASC is a charge for Public Sector employees who are members of their public sector pension scheme. It was introduced on 1st January 2019 and replaced the Pension Related Deduction (PRD) or ‘pension levy’. For most Public Sector employees this was great news, as the ASC was likely to be a smaller charge in their payslip. This year ASC has reduced even further!

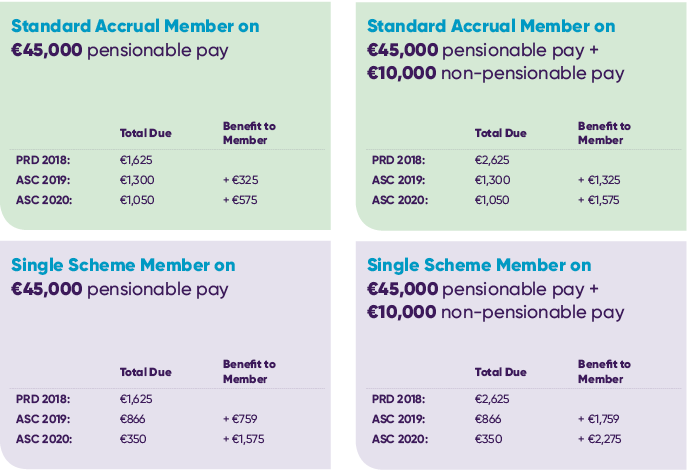

Does the 2020 reduction in the ASC really make any difference?

Yes! For example, if you earn €45,000 and joined your Public Sector Pension scheme after 2013 you would have received €759 extra in 2019 and you will receive an extra €1,575 in your take home pay this year!

How can you make the most of your extra money?

By using it to invest in your future!

Now might be the perfect time to start your Additional Voluntary Contribution (AVC) and here’s why:

1. If you weren’t expecting the reduction, it’s extra money that you might not miss!

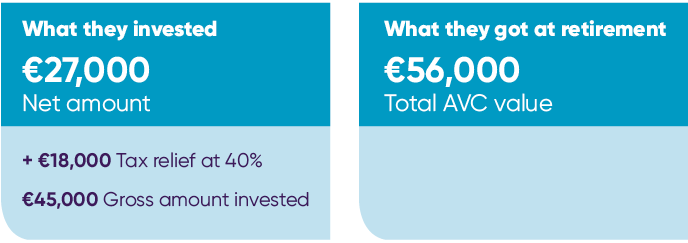

2. You’ll get an extra boost in the form of tax relief. For every €100 you contribute to an AVC you can get €40 back in tax relief, if you’re paying income tax at 40% - the real cost to you is €60.**

3. A little goes a long way, as AVCs can benefit from investment growth!

4. Between tax relief and investment growth – AVCs are a great way to save. Here’s the average AVC value for our 2019 Retired AVC Members!***