Health Insurance in Ireland used to be about hospital cover and hospital cover only. Today it’s grown substantially in terms of benefits that can be used every day with regular plan developments by the 3 providers in the market LAYA, VHI and Irish Life Health.

Up until 2016, providers would have regularly introduced price increases, on occasion up to 20%. The main reasons for these price changes include an increase in claims, large pay outs and medical inflation. Customers usually become aware of the increase when it’s time to renew their policy.

The normal pricing cycle changed during 2017 when all 3 providers began to apply price freezes with some plans even enjoying price reductions. This cancelled out an immediate need for customers to shop around to get the best value when renewing their cover.

As of June 2019, 2 years later, the freeze has ended and prices are rising again. VHI recently announced that premiums will increase by an average of 6% (and some increases up to 10%), effective from 1st August 2019. This follows on from Irish Life Health increasing prices by an average of 3% in June, whilst Laya Healthcare applied increases of a similar percentage with effect from 1st July.

Whilst this is a far stretch from when some providers increased rates by up to 40% (2014), it could be the first time in the last 3 years more customers receive a double-digit percentage increase in their renewal premium.

Once again, the main reason cited for the price increases relate to a recent spike in claims received by providers during the back end of 2018 & throughout 2019. The cost of claims has also increased meaning the providers are paying out more each month for claims.

It’s important to remember if you’re looking to take out health insurance for their first time, or looking to renew your policy, that there is an abundance of benefits and options for customers in 2019 in comparison to previous years. Your plan should be built around your lifestyle needs and the needs of your family. If you’re worried about your current plan, don’t be. You can change to a plan which better suits your needs in terms of benefits and price. You don’t even have to worry about finding it, we’ll do that for you by searching through over 325 plans from all 3 providers.

So what should you do when you receive your renewal notice from your provider?

The message is simple; don’t renew your cover until you review it! You could be missing out on significant savings by failing to shop around every year. There is only a short window to review your cover before you are tied into a new 12 month contract with significant financial penalties for canceling early. Save some money for something else this year and review your health insurance cover. At the end of the day, it’s only a phone call and you could make significant savings.

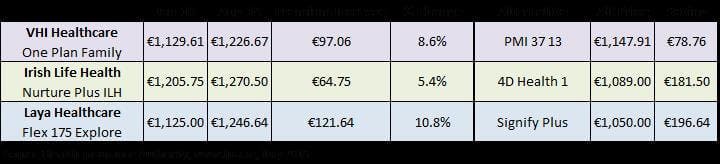

Below are examples of current plans with alternative plan options that offer similar cover at a cheaper price.

If you compare the premium from January to August 2019, some plans have increased by over 10% during that time. Avoid a premium increase & switch your plan to the alternative option:

Source Health Insurance Authority, www.hia.ie,July 2019

The alternative plans listed above are ‘corporate plans’ and all 3 providers offer a range of these plans. Customers are often unaware that these corporate plans are available to them & often provide a stronger level of cover at a lower premium to the consumer alternative.

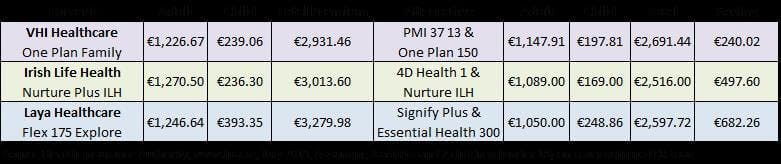

What’s more, if you have your whole family insured on the same plan and opt to insure adults and children on different plans at your renewal, the savings multiply! See below:

Source Health Insurance Authority, www.hia.ie, July 2019. Assuming 2 adults and 2 children (under 18) on cover with no LCR load

For further cost savings don’t forget to:

Take on an excess – This is the initial amount of the claim you pay and options range from €75 -€500. The higher the excess, the lower your premium will be.

Split Your Cover – All family members do not have to be on the same plan. Shop for the best plan per individual, this may be across different plans or even different providers to get the best value

Young Adult Discounts may be available (members aged 18-25). These are not available on all plans so it is important to ask your provider/advisor about them.

Watch out for special offers – if they coincide with your renewal, then you can avail of them, these are usually quite well advertised, especially when it comes to children’s cover e.g. half price kids etc.

Check out the corporate plan equivalent of your own plan – corporate plans (like the ones above) don’t suit everyone but the benefits and pricing tends to be very attractive.

And most importantly, review your plan annually to ensure your cover is up to date and competitive.

The information contained in this article has been sourced from the Health Insurance Authority, www.hia.ie in July 2019 and is the copyright of the HIA.

Cornmarket Group Financial Services Ltd. is regulated by the Central Bank of Ireland. A member of the Irish Life Group Ltd. which is part of the Great-West Lifeco Group of companies. Irish Life Health dac is regulated by the Central Bank of Ireland. Vhi Healthcare DAC trading as Vhi Healthcare is regulated by the Central Bank of Ireland. Laya Healthcare Limited, trading as Laya Healthcare and Laya Life, is regulated by the Central Bank of Ireland. Telephone calls may be recorded for quality control and training purposes.