So many things in your life depend on your salary. If you get sick and can’t work, what is your financial back up plan? If you don’t have one, start now by protecting your salary with Income Protection.

Income Protection helps many families in their time of need…

In 2021, Cornmarket administered plans paid out €46 million to plan members!*

Income Protection is designed to be there for you when you need it, to give you peace of mind by keeping some of the important things in life on track.

What do you get from Income Protection?

Income Protection is designed to provide you with a replacement income of up to 75% of your salary** if you’re ill or injured and can’t work.

How Income Protection works

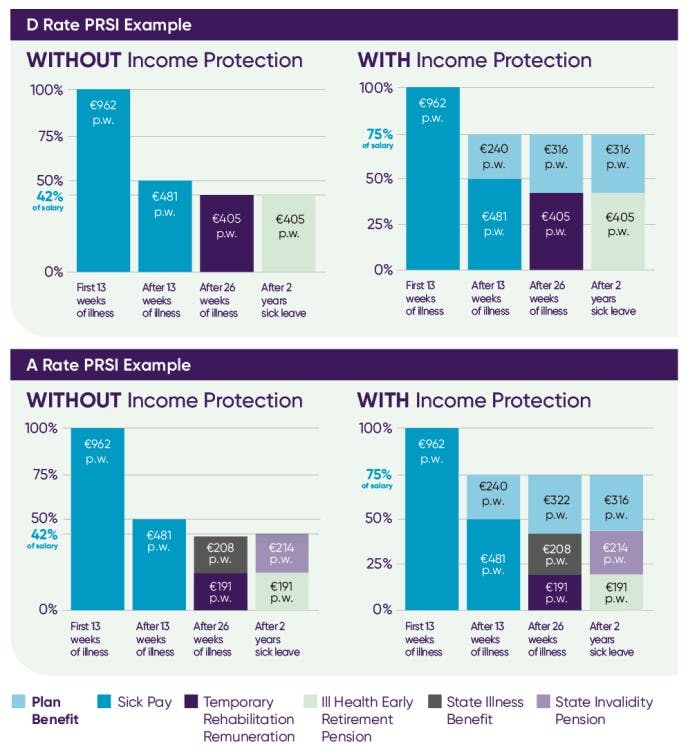

The best way to understand Income Protection is by looking at the example below, which assumes that standard sick leave applies.

John has been working in the Public Sector for 20 years and earns €50,000 per year. Sadly, John fell seriously ill and hasn’t been able to work for two years. Before John’s illness, he received €962 gross salary per week, but after 26 weeks (183 days) he has to survive on €399 per week.

After two years, John is entitled to Ill Health Early Retirement Pension and possibly State Invalidity Pension† - leaving him with an income equivalent to 42% of his salary.

If John had taken out Income Protection, he could be in receipt of 75% of his gross annual salary**.

The graphs below show the full effect on John's income if he was not a member of an Income Protection Plan; compared to him being a member of an Income Protection Plan:

Can you afford it?

One great thing about the majority of Income Protection plans is that they are a percentage of salary. That means that the premium is directly linked to what you earn! The premium can either be paid via salary deduction, which will appear on your payslip or by direct debit.

On average, every three to five years, the plan goes through an extensive review. At each review, we will make sure you get the most competitive rate and benefits on offer at that time.

What’s more, you can claim income tax relief on the Disability Benefit element of your plan premiums. On your payslip the gross amount will appear, however the net cost to you will be less.

Income Protection is one of the first steps in creating your financial back up plan. If you don’t currently have Income Protection in place, contact us to apply to join now.