It goes without saying that you love your family more than the Revenue! However, have you got a plan in place to ensure the inheritance you leave will go to your loved ones and not ‘the tax man’?

We spend our lives planning and saving for the next big steps, a home, children, college fees etc. Unfortunately, many people don’t plan for what to do with everything they have acquired, when the time comes to pass it on.

Passing your assets on to family members and loved ones is a big deal that deserves a proper plan - it’s that simple. If you plan to leave an inheritance for your estate when you die, it may be subject to Inheritance Tax; also known as Capital Acquisitions Tax.

What is Capital Acquisitions Tax (CAT)?

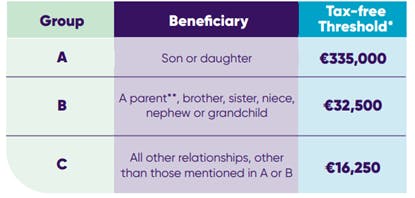

This is the amount of tax that the recipient must pay if the inheritance is over a certain limit or threshold. Inheritance can be received free from Capital Acquisitions Tax (CAT) up to a certain amount. The tax-free amount varies depending on the relationship between the inheritance provider and the beneficiary – this is known as the Group Threshold.

There are 3 different groups – A, B and C. Each group has a threshold that applies to the total inheritance received. If the inheritance amount exceeds the threshold, CAT is charged at 33%.

What else affects the tax bill to be paid?

The high Inheritance Tax rate in Ireland can mean beneficiaries facing a large tax bill. The tax bill depends on 3 main factors:

1. The relationship between the deceased and the beneficiary (the Group Threshold)

2. The net/taxable value of the inheritance

3. Any previous gifts or inheritance received by the beneficiary.

It’s important to note that if you’re married or in a civil partnership, you don’t have to pay Inheritance Tax on anything you would inherit from your spouse or civil partner.

Also, what many people don’t realise is that payment of this tax bill has to be made soon after the inheritance, and the onus is on the beneficiary to pay it and complete a full Inheritance Tax Return. Without Inheritance Planning, your family could lose part of their inheritance or be faced with the difficult decision to either sell part of their inheritance or borrow the money to pay the tax bill.

What solutions are available?

There are a number of different options available to reduce the tax burden for your beneficiaries, including:

1. A Section 72 Life Assurance Policy

2. Gifting a maximum of €3,000 per person annually (qualifies for the Small Gift Exemption)

3. Dwelling House Exemption

4. Business Exemption

5. Agricultural Relief

It’s really important to seek professional advice on what each of these options entail and to find out which is the best fit for you. Creating a CAT Plan is one of the most important things you will ever do, so it’s essential to get it right with the help of expert advice to put a plan in place now, so your gift to your loved ones has the greatest value.