In the event of your death, financial support may be a significant issue for your family. Mortgage payments, day-to-day living expenses, credit card bills and so on, will still have to be met by those you leave behind. This is why the benefits of the Fire Brigade Group Life Plan are so valuable for Fire Brigade employees.

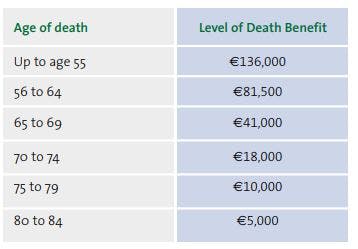

If a member of the plan dies, a lump sum will be paid. The amount of benefit paid depends on the age of the member when they die:

If a member of the plan is diagnosed with a terminal illness where death is expected within 12 months, an advance payment of 25% of the Member's Benefit will be paid.

If a member of the plan dies by accidental death, a lump sum of €15,000 will be paid in addition to the Members' Benefit.

If a member’s child (aged 0 and 21) dies, a death benefit of €5,000 will be paid.

Cornmarket and the Fire Brigade work together to secure the best price and benefits for members. When it comes to cost, you benefit from the group purchasing power of the Fire Brigade.

The cost of the Plan is €5.94 per week, and the majority of your premium is eligible for tax relief.

Please review the Plan documents above to apply for the Plan, and click here to access our Terms of Business.

Send your completed application form to:

Cornmarket Group Financial Services Ltd.

Group Protection Department

Christchurch Square

FREEPOST F3976

Cornmarket negotiate with insurers to obtain the most competitive rates and to secure the best possible benefits for members.

People are living longer, which puts more financial pressure on their retirement. For this reason, they need a level of Life Cover to make sure their loved ones are financially secure if they die and are no longer there to take care of them.

Therefore, members of the Fire Brigade Group Life Plan can remain members of this Plan after they retire. They can do this by contacting spsadmin@cornmarket.ie in advance of their retirement date stating they wish to remain a member of the Plan after they retire.

Aviva Life & Pensions Ireland Designated Activity Company, trading as Aviva Life & Pensions Ireland and Friends First, is regulated by the Central Bank of Ireland.