In the event of your death, financial support may be a significant issue for your family. Mortgage payments, day-to-day living expenses, credit card bills and so on, will still have to be met by those you leave behind. This is why the benefits of the Fórsa Group Life Plan for members of the Civil Service are so valuable.

In the event of your death, a tax-free lump sum will be paid by the Plan’s Trustees to your estate. The sum assured is based on the level of cover you choose to apply for on your application form.

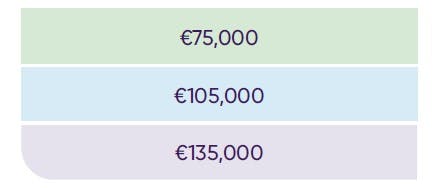

There are three different levels of cover:

Our role is to help guide your estate/Next of Kin/Solicitor through the claims process. We have considerable experience in this area and, work closely with the claimant, Insurer, and third parties to help get claims processed as efficiently as possible.

We have our own dedicated, in-house Claims Administration Team. The team members will do all they can to help at what may be a very difficult time. All claims are dealt with in a professional and sensitive manner.

The cost of the Plan is based on the sum assured you choose when applying. There are three levels of cover to choose from. The weekly costs for each level of cover are outlined in the below table.

Please review the Plan documents above to apply for the Plan, and click here to access our Terms of Business.

Send your completed application form to:

Cornmarket Group Financial Services Ltd.

Group Protection Department

Christchurch Square

FREEPOST F3976

Cornmarket negotiate with insurers to obtain the most competitive rates and to secure the best possible benefits for members.

This plan is underwritten by Aviva Life & Pensions Ireland Designated Activity Company.

Aviva Life & Pensions Ireland Designated Activity Company, trading as Aviva Life & Pensions Ireland and Friends First, is regulated by the Central Bank of Ireland.